Quick Answer: Is Silver a Good Investment in India in 2026?

TL;DR

- Yes – if you treat silver as a long-term, volatile satellite holding and phase your buys. Think 3–5 years, not 3–5 weeks.

- Use staggered purchases (DCA/micro-investing) to reduce timing risk after 2025’s record rally.

- Ideal use-case: diversify a portion of your gold allocation into silver; rebalance annually.

“In 2025, MCX silver was still headed for its best year ever, up ~157% in INR terms.” – Source

Why the Hype Now?

2025 delivered outsized returns. But after a parabolic year, pullbacks are normal – sometimes sharp.

The structural story (solar, EVs, electronics) remains strong, while India’s INR adds an extra layer to your returns.

What This Article Covers

- Whether it’s a good time to invest now, how INR affects your price, and the smart ways to buy.

- Risk checklist, allocation rules, taxes, and an easy phasing plan using micro-investing.

Target Keywords to Answer Early

- is silver a good investment in india

- is it a good time to invest in silver

- is silver a good buy now

- is it good to buy silver today

- good time to buy silver

- silver good time to buy

Is It a Good Time to Invest in Silver Now? Signals to Watch in 2026

“‘Dip buying is preferred’ for silver, notes Praveen Singh (Mirae Asset Sharekhan), Business Standard, Jun 27, 2025.” – Source

If you’re asking “is silver a good investment in India?” or “is it a good time to invest in silver,” here’s how to decide with data, not FOMO.

What Decides Your Entry

- USD silver trend vs 200-day average; confirm MCX trend and momentum in INR.

- US real rates, the Fed’s path, and inflation expectations (lower real yields generally support silver).

- China’s manufacturing pulse; global solar installations; EV sales momentum.

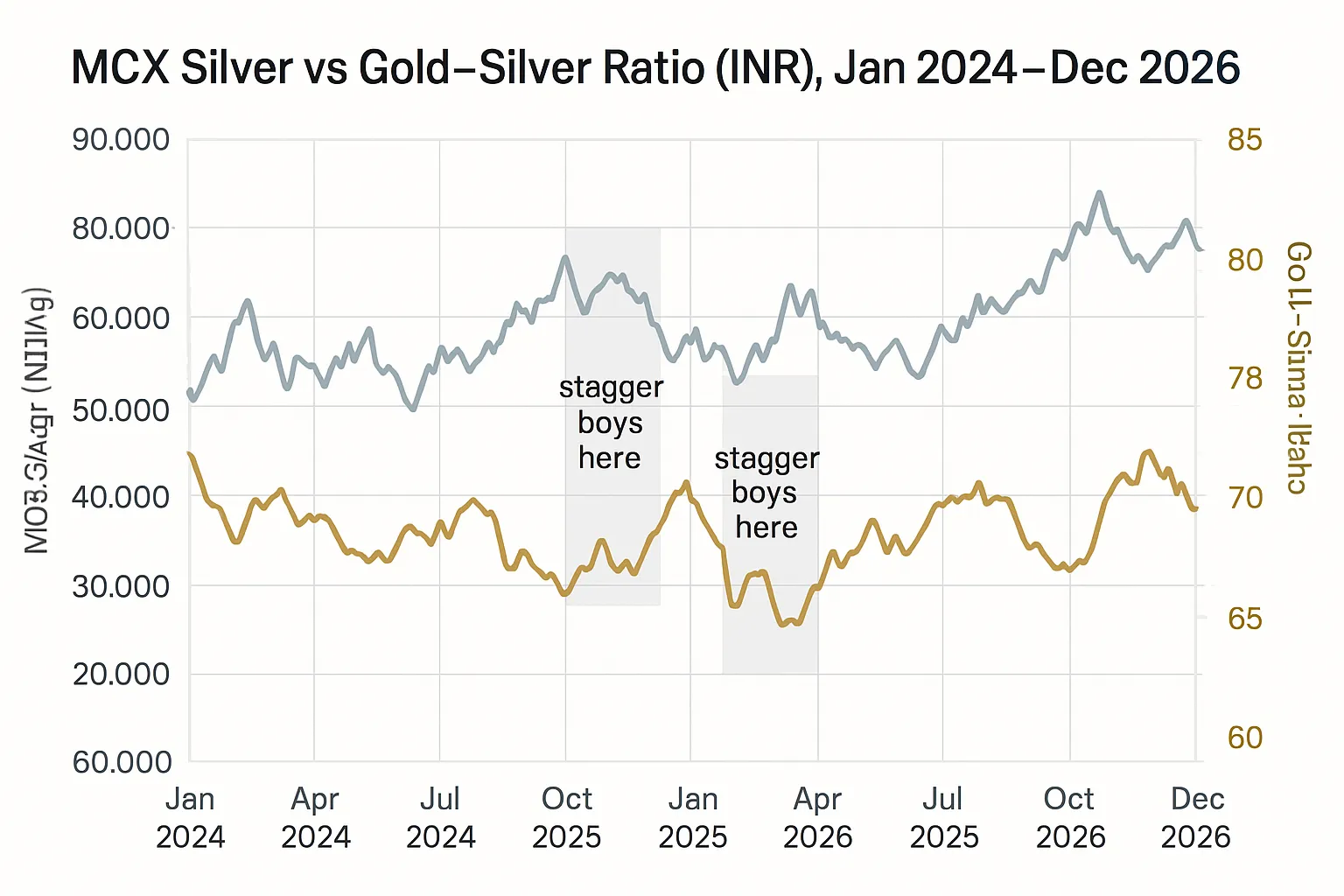

- Gold–Silver Ratio (GSR): add more silver when GSR is high; trim when it gets too low.

- INR direction: a weakening rupee can buoy local prices even if global silver pauses.

Is Silver a Good Buy Now? How to Decide Week by Week

- Use a simple rule: buy-the-dip in tranches when price drops 5–10% from recent highs.

- Combine with GSR bands:

- Accumulate when GSR > 75–80 (silver undervalued vs gold).

- Neutral between 60–75.

- Cautious when < 60 (silver may be overheated).

- Check domestic premiums and MCX liquidity before bigger allocations.

“Is It Good to Buy Silver Today?” Checklist

3 green lights:

Price above 200-DMA and trend intact.

GSR above mid-band (≥ 70–75) favoring accumulation.

INR weakening vs USD (supports MCX silver).

3 red flags:

Blow-off spikes after parabolic runs.

Extreme RSI/overbought readings with negative divergences.

Thin domestic liquidity/premiums widening on MCX or physical markets.

Visual to Ground You

- 12–18 month chart view in INR: MCX Silver vs GSR overlay, with highlighted pullback zones labeled “stagger buys here.” Use it to spot 5–10% drawdowns for phased entries.

Pro Tip for New Investors

- Don’t go all-in. Split planned capital across 6–12 tranches over weeks/months.

- Use micro-investing/DCA to automate discipline and reduce second-guessing. It’s the smartest way to handle a volatile asset like silver and aligns perfectly with “is silver a good buy now?” decisions.

Fundamentals Driving Silver in 2026: Demand, Deficits, And Why India Cares

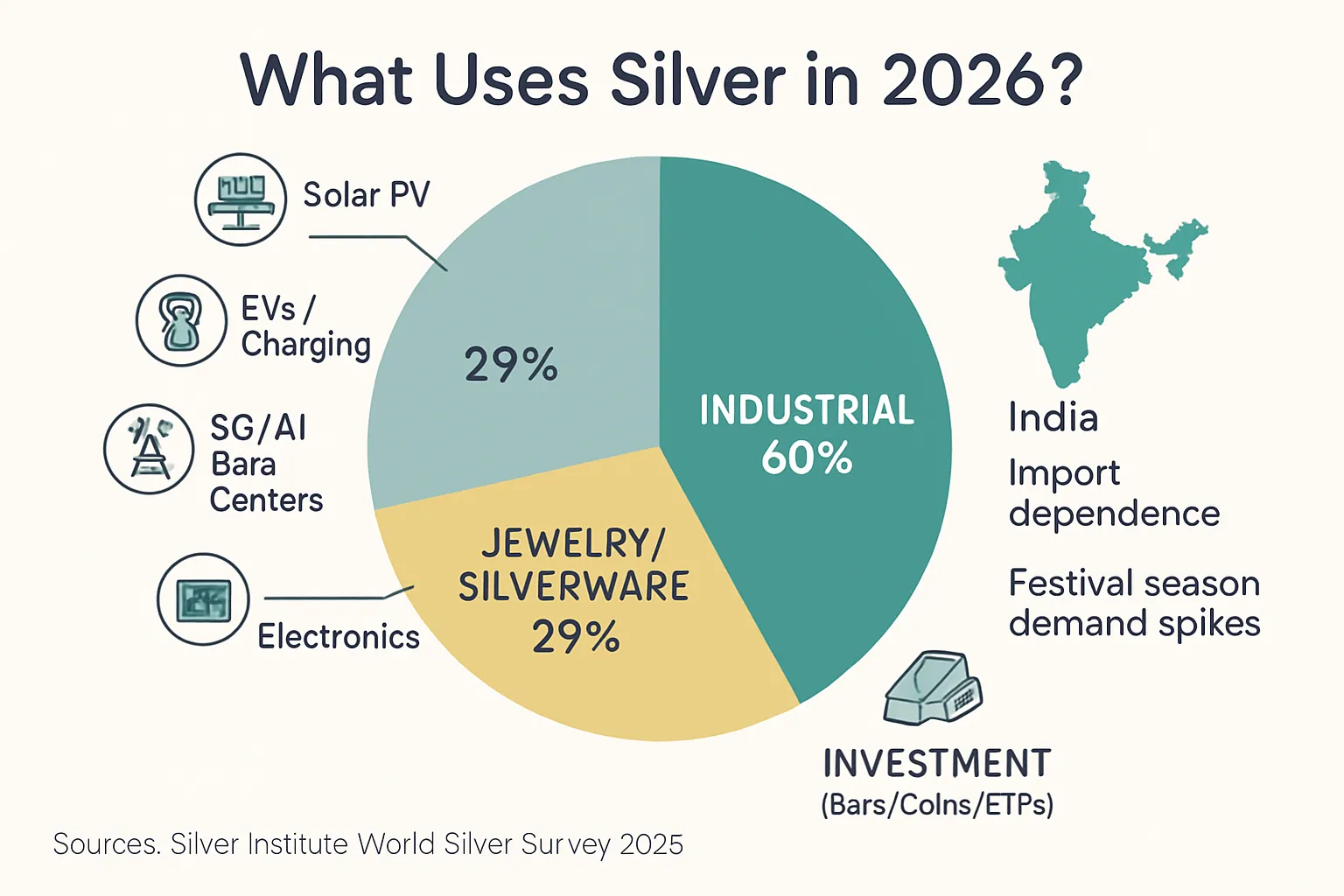

“Industrial uses made up ~58.7% of global silver demand in 2024, and the market ran a 148.9 Moz deficit – the fourth straight annual shortfall.” – Source

Industrial Demand Is the Engine

- Solar PV (TOPCon, HJT) is using more silver per watt as manufacturers push efficiency.

- EVs and charging infrastructure typically use 25–50 g of silver per vehicle across wiring, sensors, and power electronics.

- 5G, AI data centers, and consumer electronics rely on silver’s unmatched conductivity for high-frequency, miniaturized components.

Supply Tightness

Multi-year global deficit persists; much of silver supply is a by-product of lead/zinc/copper mining, limiting elastic response to price.

Recycling volumes aren’t rising fast enough to offset record industrial use.

Why This Matters in India

- India is highly import-dependent for silver; INR weakness versus USD can lift MCX prices even when global prices stall.

- Festivals and wedding seasons create bursts of local demand and premiums in key cities, tightening near-term supply.

What Could Change the Story

- Thrifting/substitution in PV and electronics if prices remain elevated for long.

- Faster mine supply if base-metal cycles turn up and by-product output expands.

Visual to Remember

Sources: Silver Institute, World Silver Survey 2025

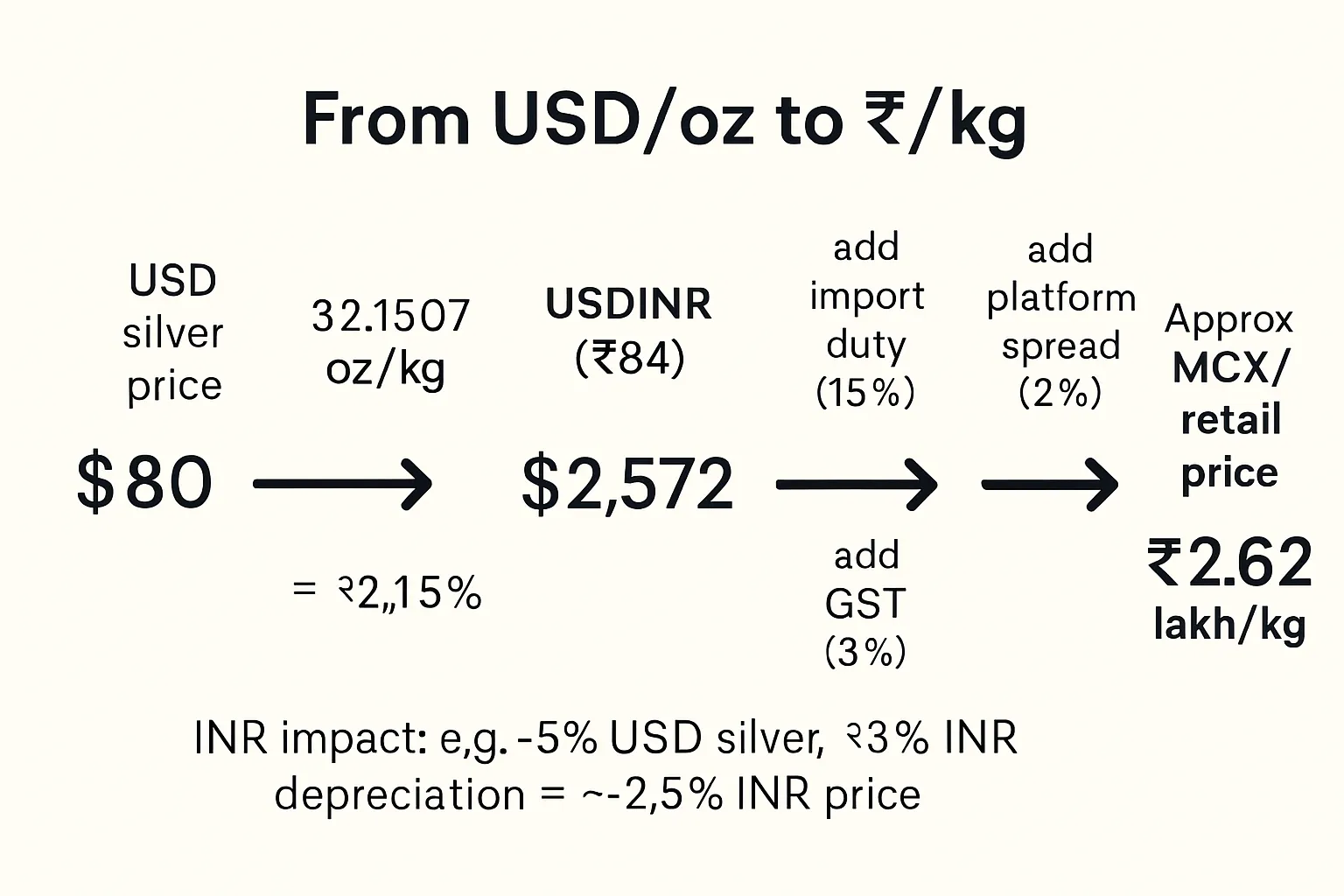

INR Math: How USD Silver Becomes Your MCX Price (And Your Returns)

The Conversion Pipeline

- USD/oz price → troy ounces per kg → USD/kg → x USD/INR → import duty + GST → MCX/retail

Why INR Direction Matters

INR weakness can lift local prices even when USD silver is flat.

INR strength can cushion global drawdowns.

Practical Takeaways

- Track USDINR along with silver.

- For short-term trades, watch basis/premiums; for investing, focus on trend + DCA.

Mini-Example

- A 5% dip in USD silver combined with a 3% INR depreciation:

- USD move: −5%

- FX move: +3% to INR price

- Approx INR impact: −2% overall, meaning MCX may not fall as much as global silver.

Cost Layering

- Import duty, GST (3%), and platform spreads (typically 1–3%) create a gap between the global reference and your buy/sell outcomes.

- Expect your executed INR/kg price to sit above the clean USD×FX conversion due to these layers.

Best Ways to Invest in Silver in India (2026): ETFs vs Digital Silver vs Physical vs Futures

Option 1: Silver ETFs/FOFs (SEBI-regulated)

- Pros: transparent NAV, low expense ratios, easy SIPs, no demat needed via FOFs, regulated custody

- Cons: tracking error vs spot, market hours/trading spreads, brokerage + TER apply

Option 2: Digital Silver (Micro-Investing)

Pros: start at ₹1, instant UPI, fractional ownership, insured vaulting, doorstep delivery option

Cons: buy–sell spread, 3% GST on buys, provider terms vary

OroPocket edge: ₹1 entry, UPI in 30 seconds, free Bitcoin rewards (Satoshi) on every purchase, daily streak bonuses, spin-to-win, gifting gold/silver

Option 3: Physical Silver (Coins/Bars)

- Pros: tangible asset, gifting/tradition appeal, delivery on the spot

- Cons: making/minting charges, purity checks and possible discounts on resale, storage/insurance hassles

Option 4: Futures on MCX (Advanced)

- Pros: leverage for tactical trades, hedging flexibility, multiple contract sizes (1 kg, 5 kg, 30 kg)

- Cons: high risk, roll/impact costs, margin calls and active monitoring – not for beginners

Which Is Best for You?

- Investors: ETFs or disciplined digital micro-investing (DCA/SIPs)

- Savers/gifters: digital silver with delivery option; traditional buyers may prefer coins/bars for ceremonies

Silver Investment Options: Quick Comparison (2026)

| Option | Min ticket size | Costs/fees (TER/spread/GST) | Liquidity | Tax treatment | Custody | Convenience | Rewards | Best for |

|---|---|---|---|---|---|---|---|---|

| Silver ETF (NSE/BSE) | 1 unit (~1g equivalent) | TER ~0.3–0.6% p.a.; brokerage + exchange charges; small tracking error | High during market hours | >24 months: LTCG ~12.5% (no indexation); ≤24 months: slab (per current rules) | Fund custodian; units in demat | Easy via broker apps; SIP via broker | None | Long-term investors wanting low-cost, regulated exposure |

| Silver FOF (Mutual Fund) | SIP from ₹100–₹500 (AMC dependent) | TER of FOF + underlying ETF; no demat required | Good (AMC cut-off NAV) | Same as above for >24 months/≤24 months (per current rules) | AMC custodian | Very easy; auto-SIP | None | Investors without demat who want SIP simplicity |

| Digital Silver (OroPocket) | From ₹1 | 3% GST on buy; platform buy–sell spread ~1–3% | High (in-app buy/sell 24×7) | Treated like physical: gains taxed per holding period; no indexation; check FY rules | 100% insured vaults | Instant UPI, fractional, delivery optional | Bitcoin cashback (Satoshi), daily streaks, spin-to-win, referrals | Micro-investors, habit builders, gifters |

| Physical Silver (Coins/Bars) | Typically 10g+ (smaller available but costlier) | 3% GST; making/minting charges 5–25%; buyback discounts | Moderate; resale at jewelers with spread | Capital gains; no indexation; making charges unrecoverable | Self-custody; storage/insurance needed | Offline or select online; verification needed | None | Gifting, rituals, collectors |

| MCX Futures (Advanced) | Margin for 1 kg/5 kg/30 kg contracts (≈12–20% of contract value) | Brokerage, exchange/CTT, spreads; slippage/roll costs | High on active contracts | Business income at slab; compliance and audit norms may apply | No physical until delivery; derivative position | Pro trading setup; active monitoring | None | Experienced traders/hedgers, short-term tactical exposure |

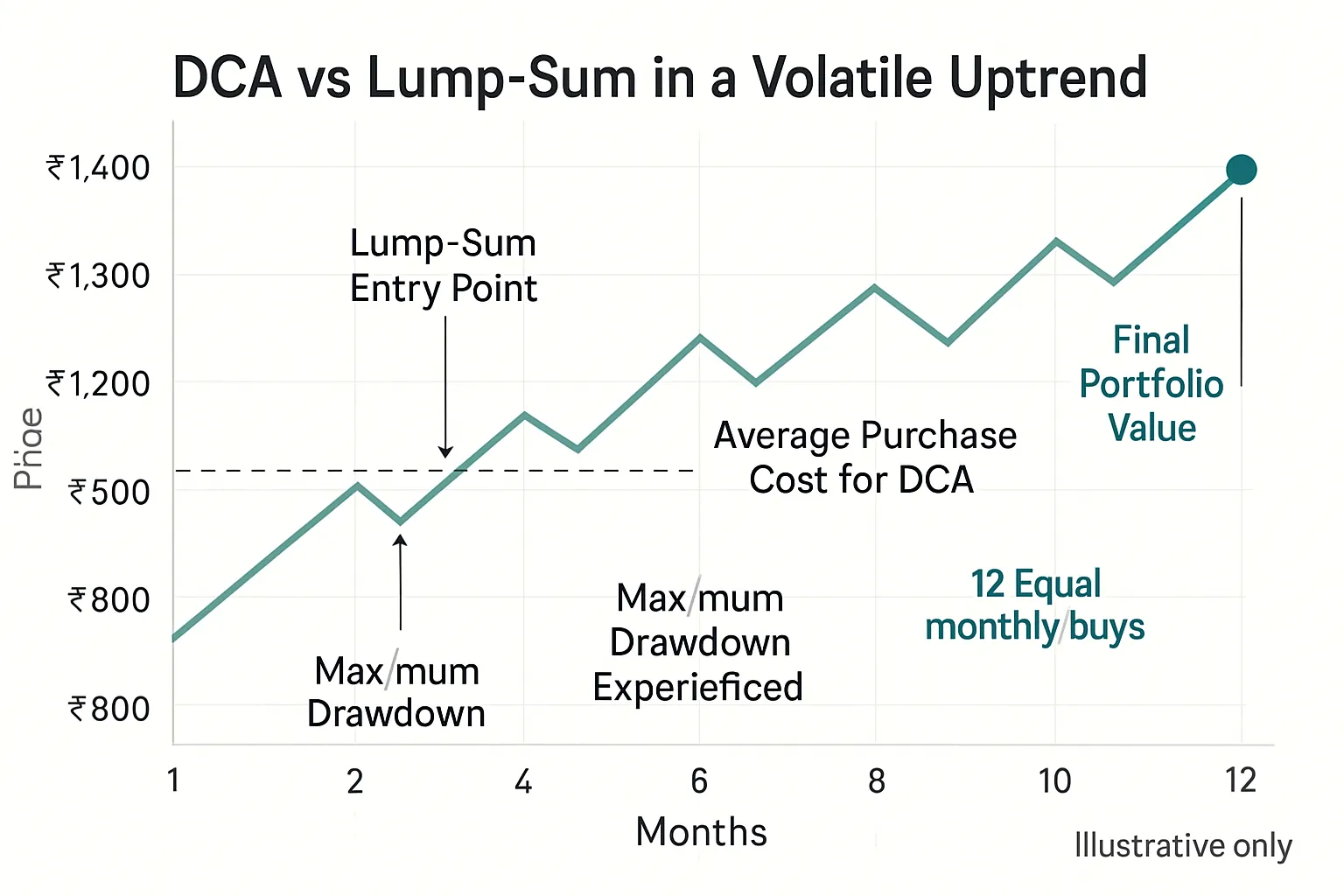

Timing Without Guessing: DCA, Micro-Investing, And Ratio-Based Adds

Why DCA Works in Volatile Assets

Reduces regret, smooths your entry price, and keeps you invested through dips instead of timing tops.

A Simple Plan for 2026

- Split your planned silver allocation into 6–12 tranches over 3–12 months.

- Add 1–2 extra tranches on 7–12% pullbacks from recent highs.

- Tilt adds using GSR bands: allocate more to silver when GSR > 75–80; neutral between 60–75; cautious when < 60.

How to Execute with OroPocket

- Start from ₹1 via UPI and automate daily/weekly buy streaks.

- Earn free Satoshi on every purchase – two assets (silver + Bitcoin rewards) for the price of one.

- Use Spin to Win for bonus gold/Bitcoin rewards; referral gives 100 Satoshi + a free spin.

- Set calendar reminders and gift silver for milestones to keep the habit sticky.

Bonus: Rebalancing Rule of Thumb

- Cap silver at 5–10% of your portfolio and rebalance annually back to target.

- Shift between gold and silver when the GSR hits extreme bands to maintain risk balance.

Visual

Risk Radar 2026: What Could Go Wrong (And How to Protect Yourself)

Key Risks

Sharp corrections after parabolic moves; −20% to −35% drawdowns are common in silver.

Stronger USD/INR or rising US real rates pressuring metals; Fed surprise hawkishness can bite.

Tech thrift/substitution if prices stay elevated (PV, electronics reduce silver loadings).

Domestic liquidity/premium swings on MCX; wider buy–sell spreads during stress.

Policy/tax changes that alter short-term behavior or post-tax returns.

Mitigations

- Staggered buying: DCA in 6–12 tranches; add only on meaningful dips (7–12%).

- Set caps: keep silver to 5–10% of your portfolio; rebalance annually back to target.

- Maintain safety net: keep 6–9 months’ expenses outside markets; avoid leverage for investing.

- Prefer safer rails: use SEBI-regulated ETFs/FOFs or trusted, RBI-compliant digital providers with 100% insured vaults.

- Process over headlines: focus on the multi-year industrial thesis; use the Gold–Silver Ratio and trend signals, not social media hype.

- Liquidity discipline: before larger buys, check MCX liquidity and domestic premiums; avoid chasing thin markets.

- FX awareness: monitor USDINR – rupee swings can amplify gains/losses in INR terms.

How Much Silver Should You Own? Allocation Rules for Indian Investors

Typical Bands for 2026

- First-time investors: 2–5% silver within your overall gold+silver bucket

- Balanced investors: 5–8% silver; total gold+silver 15–20% of portfolio

- Aggressive diversifiers: 8–10% silver; rebalance annually

Portfolio Context

Start with the 60/20/20 lens (equity/debt/gold+silver), then split gold vs silver based on risk tolerance and horizon.

Consider job/income stability, volatility comfort, and the fact that silver swings harder than gold.

Silver Allocation: Sample Portfolios (2026)

| Profile | Equity | Debt | Gold | Silver | Target bands (silver) | Rebalancing rule | Volatility notes |

|---|---|---|---|---|---|---|---|

| First-time | 60% | 20% | 15–18% | 2–5% | 2–5% | Annual calendar rebalance; trim adds after +25% spikes | Keep silver small; use DCA/micro-buys |

| Balanced | 60% | 20% | 12–15% | 5–8% | 5–8% | Rebalance annually or if GSR < 60 or > 80 | Expect -20% to -35% drawdowns in cycles |

| Aggressive | 55–60% | 15–20% | 10–12% | 8–10% | 8–10% (cap) | Rebalance annually; shift vs gold at GSR extremes | Higher return potential, higher whipsaws |

Notes:

- Total gold+silver typically 15–20% of portfolio for most investors.

- Use the Gold–Silver Ratio (GSR): add more silver when GSR > 75–80; shift toward gold when GSR < 60.

Rebalancing Triggers

- Large price spikes (for example, +25% within months) or GSR touching extreme bands.

- Annual calendar rebalancing for discipline (helps lock gains and control risk).

Scenario Plans

- If prices spike: harvest partial gains from silver; move proceeds to gold or your cash buffer.

- If prices dip: add via micro-buys/SIPs within your silver cap; avoid going over target bands.

Taxes, Costs, And Compliance in 2026: Don’t Let Friction Eat Returns

Taxes at a Glance (Indicative)

- Silver ETFs/FOFs: Long-term (>24 months) taxed at 12.5% without indexation (post July 2024 regime); STCG taxed at slab rates. Check latest AMC disclosures and your assessment year.

- Digital/physical silver: 3% GST on buys; gains taxed as capital gains or slab (structure-dependent). Review provider policy and your CA’s guidance.

- Futures: Trading gains typically treated as business income; includes audit/compliance thresholds. Consult a tax professional.

“Finance (No. 2) Act, 2024 set long-term capital gains at 12.5% without indexation for assets transferred on/after July 23, 2024 (Section 112).” – Source

Hidden Costs to Track

ETFs/FOFs: Expense ratio (TER), brokerage/exchange charges, tracking error vs spot.

Digital silver: Buy–sell spread, GST on purchases, storage/withdrawal/delivery fees (if any).

Physical: Making/minting charges, assay/purity checks, resale discounts, storage/insurance.

Futures: Brokerage, CTT, margins, slippage/roll costs, and potential impact from thin liquidity.

Compliance & Safety

- Prefer SEBI-regulated ETFs/FOFs for market exposure and transparent custody.

- For digital silver, choose RBI-compliant partners, 100% insured vaults, and regular independent audits.

- OroPocket is RBI-compliant with fully insured vaulting and authorized bullion partners; instant UPI, mobile-first convenience.

Actionable Tip

- Maintain a simple cost ledger for every buy/sell:

- Buy date and price, fees/TER, GST, spreads/premiums

- Exit price, exit costs, holding period

- This makes tax filing easier and shows your true net returns.

Conclusion: Silver Can Shine – Start Small, Stay Steady

The Bottom Line

Silver remains a high-volatility, high-conviction satellite asset for Indian investors in 2026.

The 2025 surge doesn’t kill the thesis, but it demands smarter entries and risk caps.

Your Next 15-Minute Plan

- Pick your target allocation (e.g., 5–8%).

- Set up staggered buys (weekly/biweekly) and add on 7–12% pullbacks.

- Track the Gold–Silver Ratio (GSR) and INR; rebalance annually to your target.

Why Start on OroPocket Today

₹1 entry with instant UPI, so you can phase buys without overthinking.

Earn free Bitcoin (Satoshi) on every silver purchase; daily streak rewards and spins build habit.

RBI-compliant, insured vaults, and the ability to gift metal easily.