Many While putting all your eggs in one basket may seem convenient, it can quietly introduce concentration risk. When one country, market sector, or asset class experiences a downturn, your portfolio will typically see a corresponding sudden drop as well.

By employing an asset allocation strategy that is flexible enough to provide various allocations over time across different asset classes or sectors, this risk can be minimized through core-satellite strategies. Basically, this approach combines stability with targeted growth, thus allowing an investor to own multiple diversified portfolios within one overall account (i.e., being able to mix core with satellite elements).

This also allows for an increased level of investment diversification while maintaining a very simple, uncomplicated approach. Blended portfolios tend to reduce regret associated with specific trends, unexpectedly reversing direction, and failing to perform well in all market environments consistently.

What Is Core-Satellite Investing?

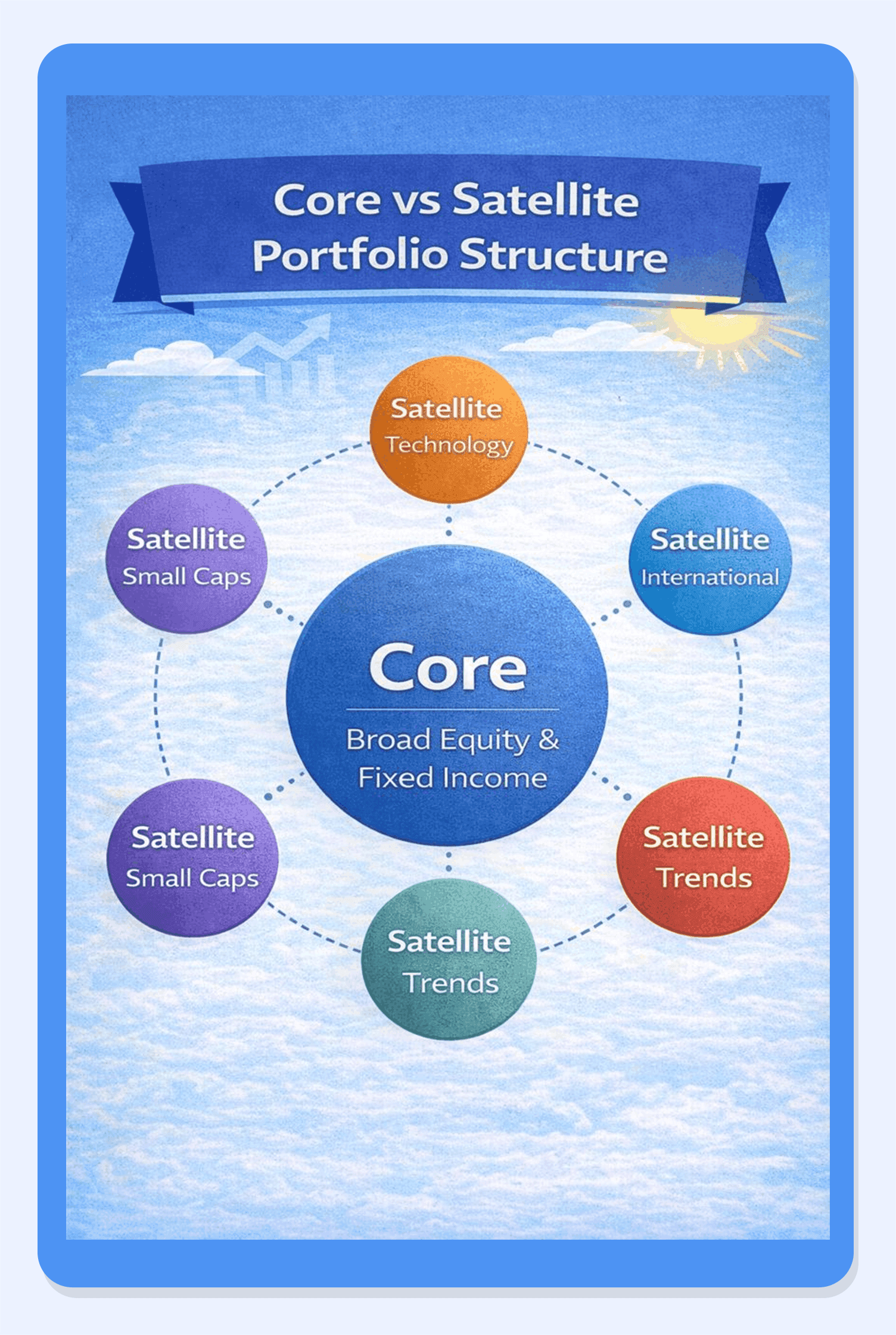

The concept of Core-Satellite Investing focuses on creating a portfolio by connecting two distinctly identified layers.

- The Core will be your foundation and will generally consist of low-cost, very diversified investments that are to be held for extended periods of time, usually in a passive manner.

- The satellites are the extra smaller sized investments or holdings around the core that typically provide the investor with an added level of opportunity.

By combining both Core and Satellite investments within one investment portfolio, it creates a balance of consistency and opportunity within the investment portfolio.Therefore, Core/Satellite Investing is an ideal long-term investment strategy.

1. Core Component Explained

The Core component is typically composed of Broad Market Index Funds, which offer an investor a consistent and stable source of return based on the performance of various global economies.

As the Core component holds the largest portion of a portfolio, it serves as the linking piece of the portfolio by acting as an anchor for an investor’s year-to-year performance. It is this function of the Core to generate and provide “engine” performance to the investor on a consistent basis, generating consistent returns over different economic and market periods.

2. Satellite Component Explained

Investment families sit both near the top of a strategic plan, while being physically located around the core portfolio. Typically, the investment will represent many different subjects over time, including:

- Technology,

- The pharmaceutical sector,

- Emerging market companies,

- And more.

It often intended for a specific strategic allocation of capital to seek out additional income or growth to augment the overall market’s basic returns. Generally speaking, when an investor places weight in satellite investments to reflect their opinion about the future performance, the investment is typically sized so that if an individual strategy under-performs, the portfolio still maintains its intended asset allocation.

Satellites are used to express the excitement and expectation of additional growth in categories where an investor is most likely to see improved returns.

How Core-Satellite Investing Works

A core-satellite portfolio consists of a core amount of the total portfolio designed to stay invested in broad-based, diversified investment holdings. The remaining portion of the total portfolio will be invested in the focus of high conviction investing to provide a higher return potential or additional diversification to the overall portfolio.

Therefore, using this strategy, the investor will build an asset allocation strategy that will be structurally disciplined and also capable of being reallocated based upon changing market perspectives. As the portfolio continues to grow and evolve, and as new methodologies are developed, the investment will be continuously monitored for performance purposes.

As investors will rebalance their portfolios from time to time, trimming back on the winning themes and building back up on those lagging securities is essential. It creates an investment which will maintain its intended diversification across all sectors.

1. Stability from the Core

The Core acts as a buffer from becoming too heavily weighted in any sector or region.

- It serves as a source of diversification, usually passively managed, that provides stability when the Satellites take a sharp turn.

- While performance in some Satellite positions may not perform to an expectation, the Core will provide a stable and predictable journey overall.

- The Core provides the investor a solid foundation to stick with their asset allocation strategy instead of becoming emotionally attached to the headlines.

2. Growth from Satellites

Satellites are a way to try and find opportunities in the market to earn an excess return above the main market for a certain time period.

An example would be an investor who adds a renewable energy fund when they believe that stronger policies and innovation will create good returns. Although the Satellite position will be limited within the Core-Satellite investment approach, it enables the Investor to achieve a reasonable amount of risk in the investment.

The value of a strong Satellite position can add a significant amount to the total return while not overly influencing the full portfolio’s profile.

What Assets Fit In Core And Satellite

The core will consist of assets that provide stability and diversification for many years, while the satellites consist of areas that may provide higher growth potential, tactical ideas, or specialised opportunities.

When combined, the two categories of investments will create a core-satellite portfolio that strikes a balance between comfort and ambition for long-term investors.

1. Core: Stable Long Term Investments

Core holdings include living entities or people that will continue to exist as long as you provide their needs. These holdings usually represent 70-80% of a typical investor’s portfolio.

Also long-term income-generating funds with a level of liquidity will be included in core holdings. It will provide long-term growth, as opposed to short-term speculation where investors try to be ‘first’ in line for a potential profit before their competition moves into the same investment.

2. Satellite: Higher Growth or Tactical Bets

Satellite holdings represent higher growth or profit opportunities that generally carry more risk. In fact, these holdings include funds that focus on specific industry sectors, styles, or themes, as well as individual stocks that you believe will outperform the market.

In a typical core investment strategy, satellite holdings are intended to comprise a smaller percentage of total investments. This is due to the increased potential for loss associated with them. Only the investor knows where their total asset allocation should be, and many investors will allocate the majority of their net worth to core holdings, with only a small percentage to satellite holdings.

Who Should Use Core-Satellite Strategy?

The core-satellite investment strategy is designed for investors that want a consistent amount of structure while still allowing themselves a certain degree of flexibility. It has a good fit with those who are willing to experiment within their portfolio, however, will also want to maintain long-term stability.

1. Long Term Investors

Those who are saving for retirement, their children’s education, or future independence will benefit considerably from this investment strategy. Core-satellite works best for most of the investors while using their core investment to function.

Since these investors can depend on the core, they can replace their satellite investments as their investment philosophy changes. This eliminates the need to reconfigure their investment strategy on a regular basis.

2. Goal Based Portfolios

Investors aiming for specific outcomes can structure dedicated core–satellite portfolios around each financial goal. For example, a goal such as buying a home may call for a balanced mix of conservative and growth-oriented holdings, helping manage risk while preserving steady progress.

In contrast, a long-term goal focused on wealth creation would typically follow a more aggressive core–satellite strategy, with a higher allocation to equities compared to other asset classes to maximise growth potential.

Conclusion

Core-satellite investing works because it respects two realities at once. Most investors need stability to stay invested through market cycles, and at the same time, they want room to act on opportunities when they see them. A strong core keeps the portfolio grounded, diversified, and aligned with long-term goals, while satellites allow for tactical moves without putting the entire portfolio at risk.

What this really means is better discipline, fewer emotional decisions, and a clearer asset allocation strategy that can evolve over time. Instead of constantly reacting to market noise, investors can focus on building a portfolio that balances comfort with ambition.

Platforms like Grip Invest make this approach easier to implement by offering access to diversified fixed-income options that can form part of a stable core, alongside opportunities to add return-enhancing assets thoughtfully. When used well, a core-satellite portfolio is not about chasing trends, but about building a structure that lets long-term investing actually work.

FAQs

1. Is the core-satellite investment strategy a good approach for beginner investors?

Yes. The core-satellite investment strategy starts with a basic and diversified core investment and allows for the addition of satellite investments (as an investor becomes more educated and experienced) small increments at a time.

2. What is the optimal percentage of the core investment in a core-satellite portfolio?

Most investors will keep the majority of their core investment in the core satellite portion of their portfolio. The actual percent of each portion of core satellite investments will depend on the investor’s risk tolerance level, the investor’s time frame for their investments, and the investor’s investment goals.