Geopolitical shocks and uncertainty often impose volatility on markets. In such a scenario, investors take refuge in safe-haven instruments like gold and silver. The high intrinsic value of these metals acts as a hedge against volatility and an optimal store of value. Therefore, precious metals often rally in response to geopolitical shocks.

Keeping with this trend, the current skirmish between the US and Venezuela has resulted in a rally of geopolitical risk assets. This blog provides a comprehensive analysis of the ongoing Gold Silver Haven Demand after the Venezuela crisis to explain the broader pattern of asset price movements and inform planned investments. Let us begin with decoding what happened in Venezuela.

Also Read: Fastest Growing Sectors In India In 2026 – Top 10 Picks

What Happened In Venezuela And Why It Matters

On 3 January 2026, the United States carried out military strikes against Northern Venezuela and Caracas, the capital of the country, under Operation Absolute Resolve1. Over 150 aircraft launched from 20 bases neutralised the Venezuelan air defences with airstrikes on radar and power systems. The raid that lasted about 30 minutes resulted in the extraction of President Nicolás Maduro and his wife by the Delta Force commandos inserted via MH-60 helicopters at 2:01 AM2,3.

With Maduro being flown to New York, facing trial under American jurisdiction, political instability continues to prevail in Venezuela. Although Delcy Rodríguez, the Vice President under Maduro, has been sworn in as the President, the country remains in the fog of the military escapade4. This event can have major ramifications in the financial markets.

Ripples Across Global Financial Markets

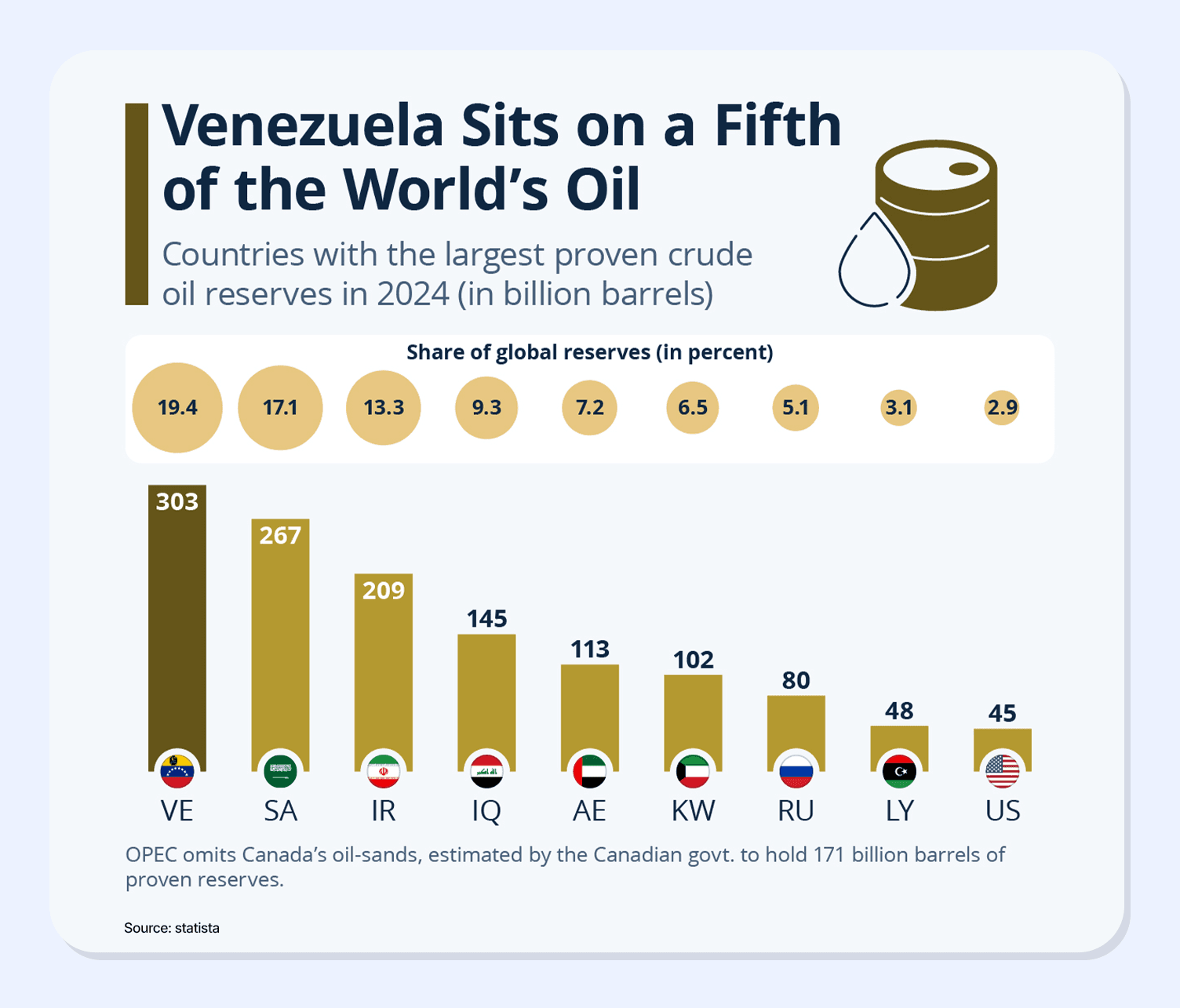

Venezuela holds approximately 303 billion barrels of proven oil reserves, which is about 20% of global reserves. However, the country contributes less than 1%, that is, 0.8% of global crude output.

The political instability in such an oil-rich nation can result in market reactions like a gold or silver price rally. It can impact the financial markets, similar to how major geopolitical events have caused ripple effects in the markets, as investors move towards safe-haven instruments.

Precious Metals As Safe-Haven Assets Explained

Assets that are anticipated to retain or increase their value amidst economic turmoil, geopolitical events, and market downturns are called safe-haven assets. Precious metals like gold or silver act as safe-haven instruments as investors flock to them with declining confidence in market instruments like equity or currency to get capital preservation, appreciation, or diversification.

Silver or Gold Safe Haven 2026 can offer this hedge better than other assets due to the following reasons.

1. Intrinsic value and scarcity: Gold or silver are tangible assets with a scarce supply, resulting in a high intrinsic or real value. This is unlike commodities like currency or equity, which have notional value and are prone to devaluation resulting from a market downturn.

2. Liquidity: These assets often have high liquidity, making them suitable for uncertain periods.

3. Historical stability: The safe-haven assets have historically experienced rallies and preserved capital during past economic or geopolitical downturns that flung capital markets into volatility.

A closer look at the current reaction of Gold Silver Haven Demand after the Venezuela crisis and past instances is necessary to decode this trend and implement it in an investment strategy.

Market Reaction: Gold And Silver Price Moves

The U.S. strikes in Venezuela increased the appeal of bullion, as gold and silver witnessed a rally. Extending the gains on Friday, the gold price surged 2% to reach USD 4,430 per ounce on Monday, 5 January 20266. Currently, on Tuesday, 6 January 2026, the gold rates rose above USD 4,460 per ounce. The chart below shows a one-week trend of gold rates, as of 6 January 2026.

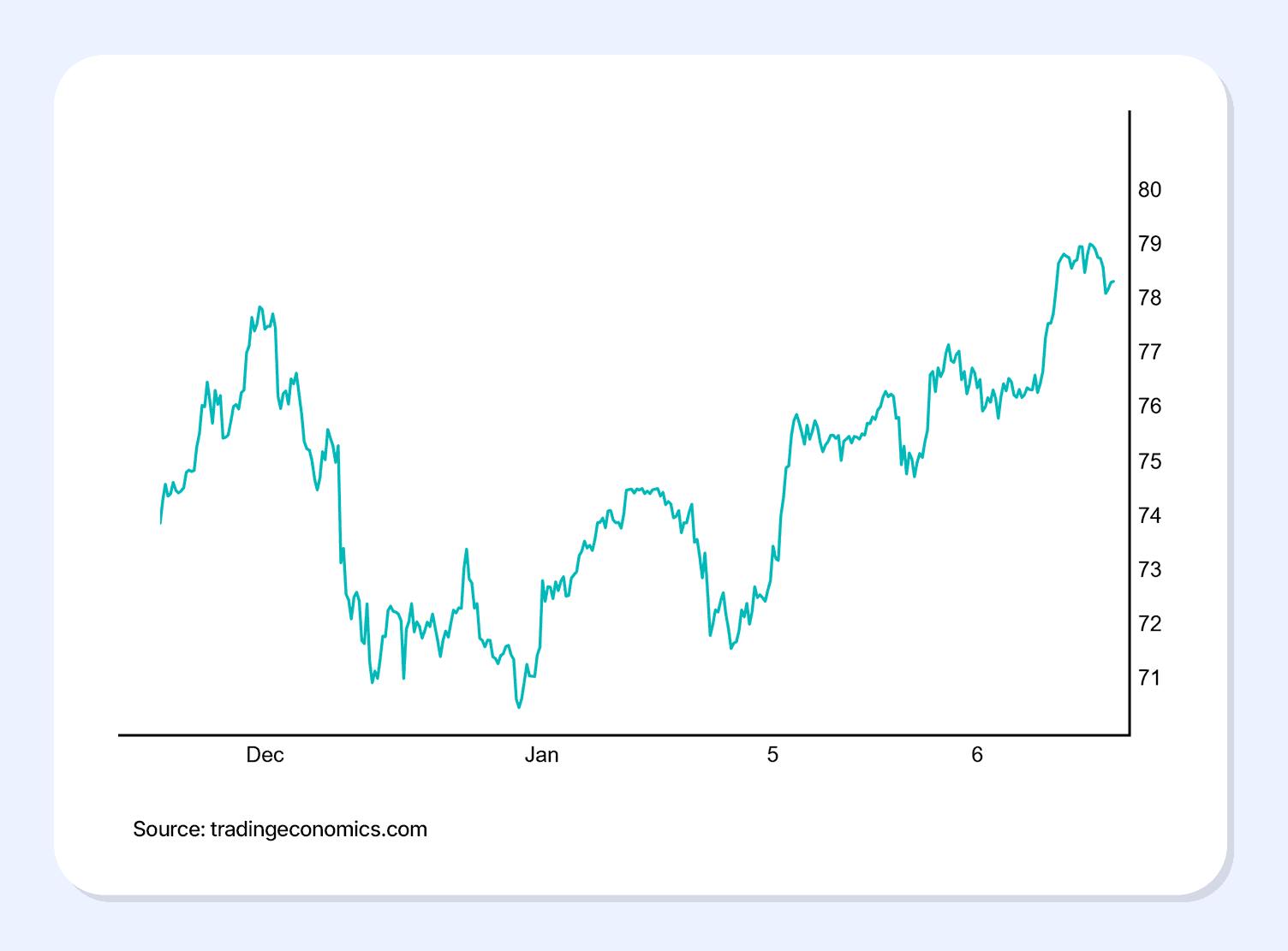

The surge in silver is higher than that of gold. With a hike of 4%, the silver prices rose to USD 76 per ounce on Monday, 5 January 20267. Tuesday saw further growth to USD 79 per ounce. The chart below shows a one-week trend of silver rates, as of 6 January 2026.

The table below highlights the per-gram silver and gold prices in India amidst the US-Venezuela skirmish.

| Day | Gold Price India (24K)8 | Silver Price India9 |

| 6 January 2026 | INR 13,882 (+60) | INR 253 (+5) |

| 5 January 2026 | INR 13,822 (+240) | INR 248 (+7) |

| 4 January 2026 | INR 13,582 (0) | INR 241 (0) |

| 3 January 2026 | 13,582 (-38) | INR 241 (-1) |

The Gold Silver Haven Demand after the Venezuela crisis is not abnormal, but a trend of safe-haven rally post global uncertainty, the points below discuss this historic precedent.

1. 2008 Global Financial Crisis: The financial crisis of 2008 witnessed gold as a safe-haven asset. The Producer Price Index (PPI) for gold climbed by 101.1% between 2008 and 2012, indicating a significant increase in the value of gold10.

2. COVID-19 Pandemic: During the Pandemic, precious metals witnessed a major rally as investors prioritised capital preservation. In August 2020, gold prices surged over 30% and reached USD 2,000 per ounce for the first time11.

3. Trump Tariffs: 2025 began with gold at USD 2,600 an ounce12. However, the onset of tariffs by US President Donald Trump caused a surge of over 68% in gold rates in 2025, as investors craved caution. Silver rose by 138%, while platinum reached a 17-year high in 2025.

Major events that push capital markets into volatility prove time and again the relevance of gold and silver as a safe-haven asset.

What This Means For Investors Today

Market volatility triggered by major geopolitical events upholds the importance of safe-haven assets and diversification. Although precious metals witness a rally, diversification into fixed assets, like bonds and high-yield FDs, can give a sense of stability through fixed and predictable returns.

Grip offers up to 12.5% YTM on corporate bonds, along with inflation protection and security cover. Visit Grip Invest Today!

FAQs

1. What causes gold and silver to rise after geopolitical events?

Major geopolitical events often create volatility in capital markets. As a result, investors choose safe-haven assets like gold and silver that have high intrinsic value and have held steady growth during volatile markets.

2. Is safe-haven demand the only reason for bullion rallies?

Several factors can contribute to bullion rallies, such as strong industrial demand, heightened central bank buying, festive demand hike, etc. However, acting as a safe-haven asset is a key factor in bullion demand.

3. Should investors buy precious metals now?

Diversification into precious metals during uncertain scenarios can be an optimal investment choice. However, complete investment in any asset can increase risk. A well-diversified portfolio with precious metals, fixed-income assets, and some market assets for growth after markets stabilise can be optimal.

4. How do metals compare with bonds during risk-off periods?

High-quality government bonds and precious metals generally outperform the market securities during volatile conditions. Diversification into metals, fixed-income assets, and so on can be a key to maintaining the risk health of the portfolio.