Meher had just shortlisted her first bond investment and immediately called her brother, Ishaan, to share the news. She explained that the bond matched her financial goals and offered a fixed interest rate that felt comfortable. Ishaan listened and then asked a simple question: had she checked recent interest rate movements or followed what the central bank was signalling? Meher sounded confused. She replied, “Why would that matter? The bond is fixed-rate, and it fits my plan.”

Ishaan explained that while bond interest payments remain fixed, bond prices do not. “Fixed-rate does not mean market-proof,” he said. When interest rates change, the value of existing bonds adjusts to stay competitive with new issuances. Central bank policies, inflation expectations, and rate cycles all influence how bonds behave after purchase. That explanation changed Meher’s perspective. She realised that selecting a bond involves more than just matching returns to goals. “I am glad I called you before investing,” she admitted, appreciating the importance of broader market research.

Building a comprehensive financial portfolio is not an easy task. This is because even fixed-rate investment strategies are not fully free from market movements. While several remain oblivious to interest rate risk, it is always good to take a broader look at the market.

Why Interest Rate Risk Impacts Every Investor

When it comes to the market and investing, everyone has a different appetite for risk. But no matter how low one’s risk capacity is, it can never be zero, even if they opt for the safest, most predictable options like fixed-rate instruments. It is because even bond prices and their output are impacted by interest rate movements. The cardinal rule is that bond prices move inversely with interest rates, and therefore, they are not immune to interest rate risk.

What Is Interest Rate Risk?

Interest rate risk is the possibility that changes in market interest rates will reduce the value of an investment, especially fixed-income instruments like bonds, by making existing returns less attractive compared to new rates. In simple words, interest rate risk meaning is, it is the risk that investors who have invested in fixed-rate instruments face due to changes in interest rates.

So, when interest rates rise, existing bonds with lower rates become less attractive, and when rates fall, existing bonds gain value. The main reasons include central bank policy moves, inflation expectations, market credit demand and supply, economic cycle shifts, and unexpected geopolitical or macroeconomic events.

How Interest Rate Risk Affects Bonds

The interest rate impact on bonds is such that when the interest rate rises, bond prices reduce, making existing bonds with lower rates less attractive. Simply put, bond prices and market interest rates move in opposite directions. This happens because interest rates in the broader economy are always moving but payouts of fixed-rate instruments do not change when the market’s interest rates do.

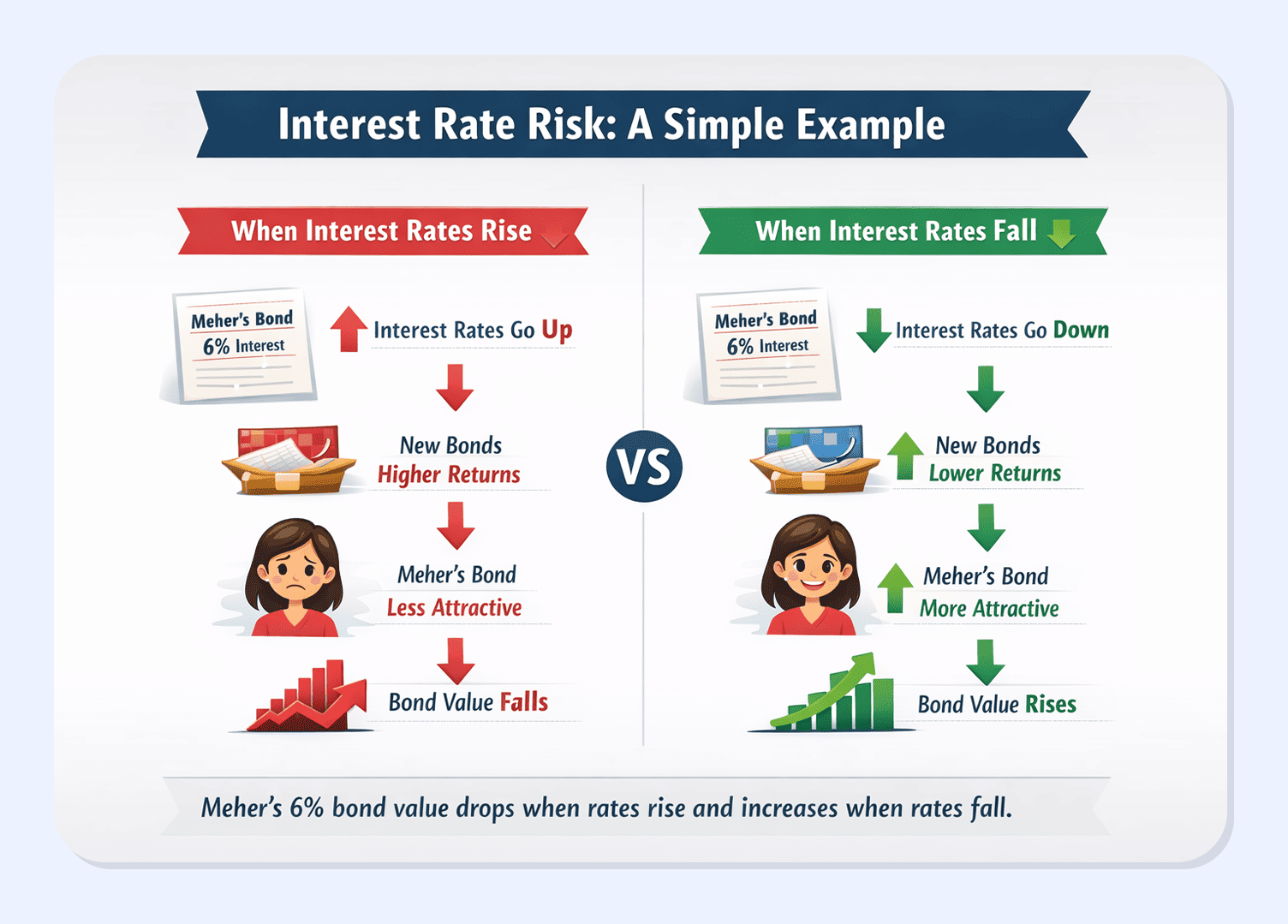

Let us understand this with the help of an example:

Suppose Meher buys a bond paying 6% interest. If market interest rates later rise to 7%, new bonds begin offering higher returns. As a result, Meher’s existing 6% bond becomes less attractive, and its market value falls. On the other hand, if interest rates drop to 5%, the same bond becomes more valuable because it now offers a higher return than newly issued bonds.

Impact Depending On Terms Of The Bonds

The impact of the same will also differ based on the term of the bond. Short-term bonds have lower sensitivity to interest rate risk, whereas long-term bonds have higher sensitivity.

1. Short-term bonds mature quickly. Since their money is returned sooner, investors are not locked into a fixed interest rate for long. Even if interest rates change, the bond will mature soon and can be reinvested at new rates. As a result, short-term bonds exhibit lower sensitivity to interest rate movements.

2. Long-term bonds lock investors into a fixed interest rate for many years. If interest rates rise, investors are stuck earning a lower rate for a long time, making the bond less attractive. To compensate, the bond’s price must fall more sharply. This is why long-term bonds are more sensitive to interest rate changes.

Also Read: Short-Term Vs Long-Term Bonds: Which One Should You Pick In 2025?

Interest Rate Risk In Other Investments

Interest rate risk does not only affect bonds; it also affects other fixed-rate investments in the market. Debt funds are directly affected because they own fixed-income securities, and changes in interest rates affect their NAVs. Longer-duration debt funds are more sensitive to changes in interest rates than shorter-duration and floating-rate funds, which tend to stay stable.

This is the same effect that interest rates have on bonds. Different things happen to stocks. When interest rates go up, it costs companies more to borrow money and the discount rates used to value stocks go up. This can hurt growth stocks more than defensive or cash-rich sectors.

Managing Interest Rate Risk In A Portfolio

The Interest rate impact on bonds cannot be completely mitigated. But with smart financial choices, you can build a portfolio that will help you manage interest rate risk:

1. Diversification Across Maturities

The first thing that you must do is diversify your portfolio. Diversification helps by absorbing the impact of interest rate changes by spreading investments across different maturities. So, instead of putting all your money in one place, invest in a mix of different instruments. This way, you can reduce concentration risk.

2. Balancing Short-Term And Long-Term Instruments

Diversification does not stop at choosing different investments. You must also diversify your investment based on its tenure. Instead of putting all your money into a single tenure, invest in a mix of short-, medium-, and long-term instruments.

3. Using Laddered Investments

Another important investment strategy is laddering. What this means is that you spread your money not only across instruments or tenors, but also across maturity dates. This approach will help you in reducing interest rate risk by avoiding overexposure to a single date cycle.

Conclusion

Interest rate risk is one of those realities that quietly shapes returns, even in investments that look predictable on the surface. Bonds may offer fixed payouts, but their prices respond constantly to changing rate cycles, inflation trends, and central bank decisions.

What this really means is that smart fixed-income investing goes beyond headline yields. It requires aligning bond tenures with goals, balancing duration exposure, and staying aware of where rates may be headed.

Platforms like Grip Invest make this easier by offering access to curated fixed-income opportunities across tenures, helping investors build portfolios that aim for stable returns while managing interest rate risk more thoughtfully.

FAQs

1. What happens to bonds when interest rates rise?

Bonds always move in the opposite direction to the interest rate. So, a rise in interest rate impact on bonds is that the bonds move downward, and their prices will fall to adjust the yields. As a result, existing bonds will become less attractive compared to new issues. The impact will be even greater on long-term bonds.

2. How can investors reduce interest rate risk?

While it is impossible to completely mitigate interest rate risk, it can be managed with good financial planning. Some of the things that wil work in your favour include investing in shorter-duration instruments, using staggered maturity strategies, diversifying across asset classes, and lastly, matching investments with financial goals and timelines.

3. Is interest rate risk relevant if I plan to hold bonds till maturity?

Yes. While holding a bond till maturity protects you from interim price fluctuations, interest rate risk still affects liquidity, reinvestment opportunities, and portfolio flexibility. Rising rates may not reduce your final payout, but they can limit your ability to exit or rebalance efficiently during the investment period.