Investors seeking ways to preserve capital while also earning steady returns should look towards fixed-income investments. This idea makes bonds and debt funds the ‘go-to’ choice for many investors in India. The basic aim for both instruments is to provide a stable income and reduce volatility.

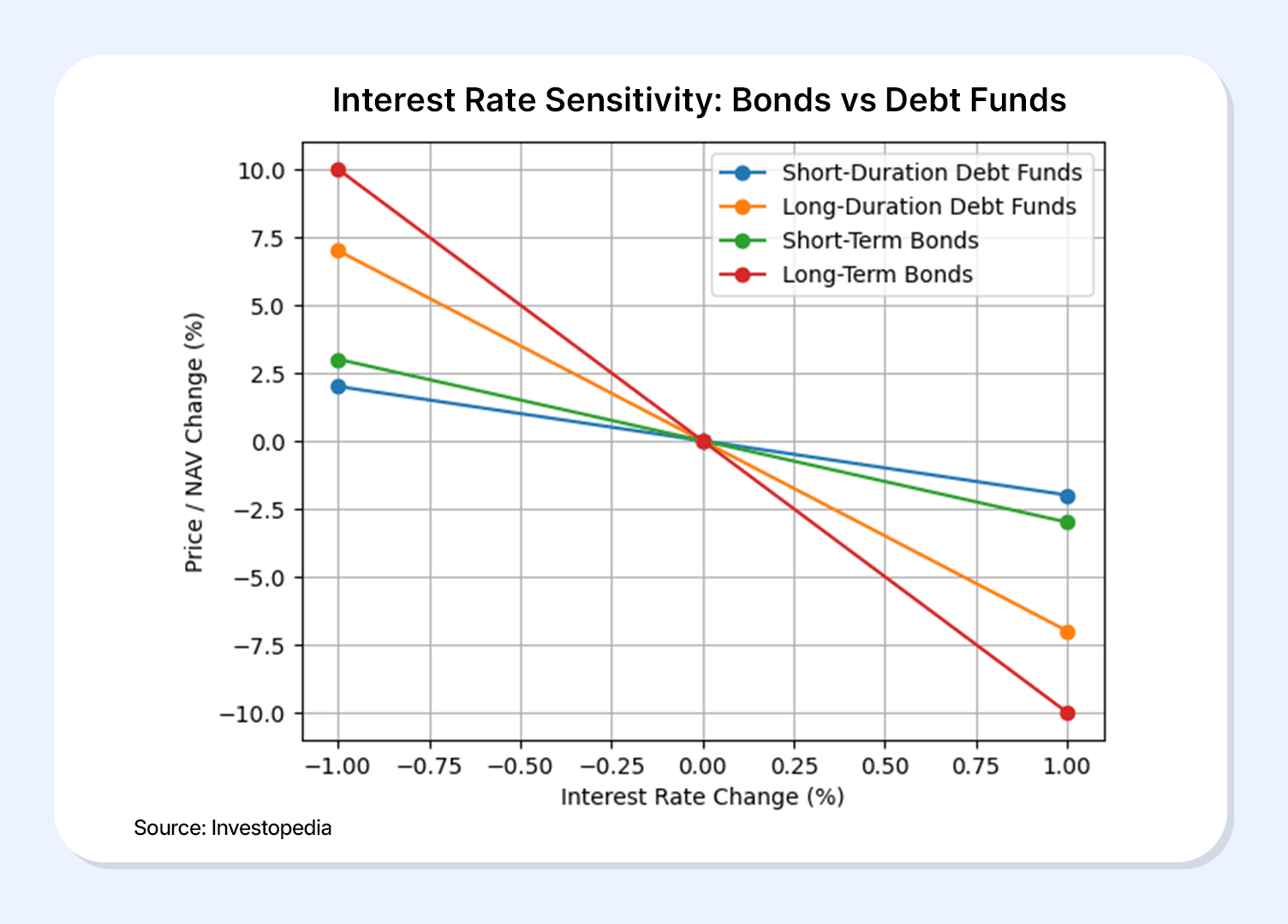

The argument regarding bonds vs debt funds turns out to be more relevant during uncertain interest rate cycles. Investors interested in fixed-income instruments should reassess their direction of cash flow as the rates rise and fall.

To know more about fixed income comparisons and learn which fits you better, read through this blog. Having an objective will help you make informed choices, making your financial goals more structured than perceived.

Bonds Vs Debt Funds: Key Differences

To choose between the two, you have to first understand the fixed income comparison between bonds and debt funds. The table shows how they differ under different factors.

| Factors/ Parameters | Bonds | Debt Funds |

| Investment Type | Direct Investments.Generally issued by the government, the public sector, or corporations. | Indirect Investment type.Investment made through mutual funds. |

| Return Predictability | Defined by coupon structure and face value.Very predictable if held till maturity. | Predictability is low. This happens due to regular Net Asset Value Fluctuations. |

| Liquidity | Moderate liquidity.Depends on secondary market demands | High liquidity. |

| Expense Ratio | Embedded in the purchase price and yield. | Annual expenses. Reduces net return with time. |

| Investor Suitability | Best for inventors seeking predictable income and stability | Best for investors seeking diversification and liquidity. |

Which Option Suits Different Investors?

Having to choose between the two depends entirely on your financial goals, time, and risk appetite.

1. Conservative investors

For conservative investors, the factors that make the list are capital preservation and high returns. This makes bonds more suitable for them. Default risks can be reduced by investing in high-quality government bonds and top-rated corporate bonds, and if held till maturity, they could also ensure principal repayment.

Debt funds might also work out if you are a conservative investor, but it applies mostly to short-term funds with liquidity. In the case of long duration, you might face unnecessary volatility.

2. Short-term vs long-term goals

The term duration is also a major deciding factor before making a choice. In the case of short-term goals, debt funds are recommended as they are more flexible. With easy entry and exit, they allow you to make investments while also not making you worry about the market depth.

On the other hand, long-term goal investors would do better by choosing bonds that provide clarity. You can improve your income stability by locking into higher yields for longer time periods.

Bonds And Debt Funds In A Balanced Portfolio

Balancing your portfolio and working for a more structured financial goal comes with combining bonds and debt funds. This also helps balance stability, flexibility, and liquidity.

Let us understand this by using a hypothetical scenario.

Say, you are a moderate-risk investor, having a medium-term horizon. Your supposed objective should be liquidity paired with a stable income.

The following table shows the distribution of funds for the best outcomes:

| Investment Instrument | Allocation of Funds |

| Corporate Bonds | 40% |

| Government Bonds | 20% |

| Short-term Debt Funds | 25% |

| Liquid Funds | 15% |

Conclusion

The focus while choosing between bonds vs debt funds shouldn’t be on which is a superior instrument; it should be on aligning your investment choices with your financial goals. Since both have different roles when it comes to investment, a smart and careful allocation strategy is needed.

While bonds offer predictable cash flow and clarity, debt funds provide liquidity and diversification. The best option for most investors is a combination of both. This will allow you to make your portfolio more adaptable without having to sacrifice stability. Trusted platforms like Grip Invest provide a curated list of such investment instruments so that you can invest with transparency and seamlessly.

Access to the best fixed income instruments, invest with Grip Invest today!

FAQs

1. Are bonds safer than debt funds?

Bonds are generally considered safer compared to debt funds when held till maturity. The reason being the issuer commits to fixed coupon payments and principal repayment. Bonds that are of high quality, like government securities or AAA-rated corporate bonds, carry lower risks.

2. Which is better for a regular income?

For a regular income, bonds are better than debt funds, as they are predictable. Having such an income makes cash flow planning easier for investors.

3. How are bonds and debt funds taxed in India?

Bond taxation depends on the type of bond and holding period. Interest income from bonds are taxed as per the investor’s income tax slab. For debt mutual funds, gains are taxed as short-term capital gains if held for up to 36 months and long-term capital gains thereafter, as per prevailing tax rules.

4. Can debt funds lose value while bonds remain stable?

Yes. Debt fund NAVs can fluctuate due to interest rate changes, credit events, or market volatility. Bonds when held till maturity, are less affected by interim price movements and generally return the principal amount assuming no default by the issuer.

5. Is it possible to invest small amounts in bonds compared to debt funds?

Traditionally, bonds required higher ticket sizes making them less accessible. However today investors can invest in bonds with smaller amounts through digital platforms. Debt funds remain more flexible for small to very small investments due to SIP options and low minimum investment requirements.