What “Best Time” Really Means (Quick Answer + How Gold Moves)

Quick answer

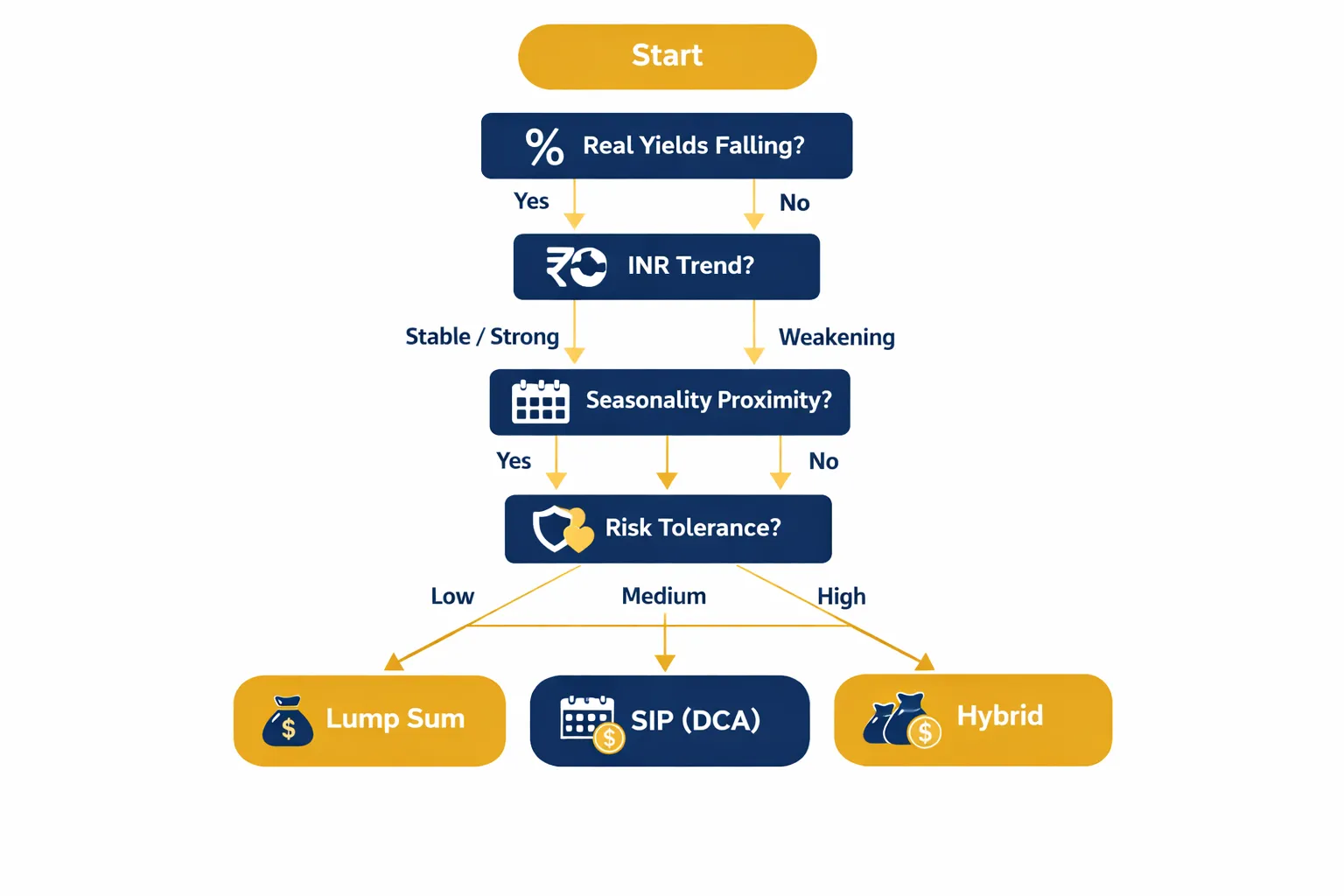

- The best time to buy gold is when real interest rates are falling, the INR is stable/strengthening, and before seasonal festival demand spikes. If you’re new or busy, start now with a small SIP and add extra on dips.

- For India, watch domestic triggers (RBI policy, INR, import duties) as much as global ones (US real yields, USD strength, risk events).

What actually drives gold-in-INR

- Real yields: When inflation-adjusted rates fall, gold tends to rise.

- USD strength: A softer dollar supports global gold prices.

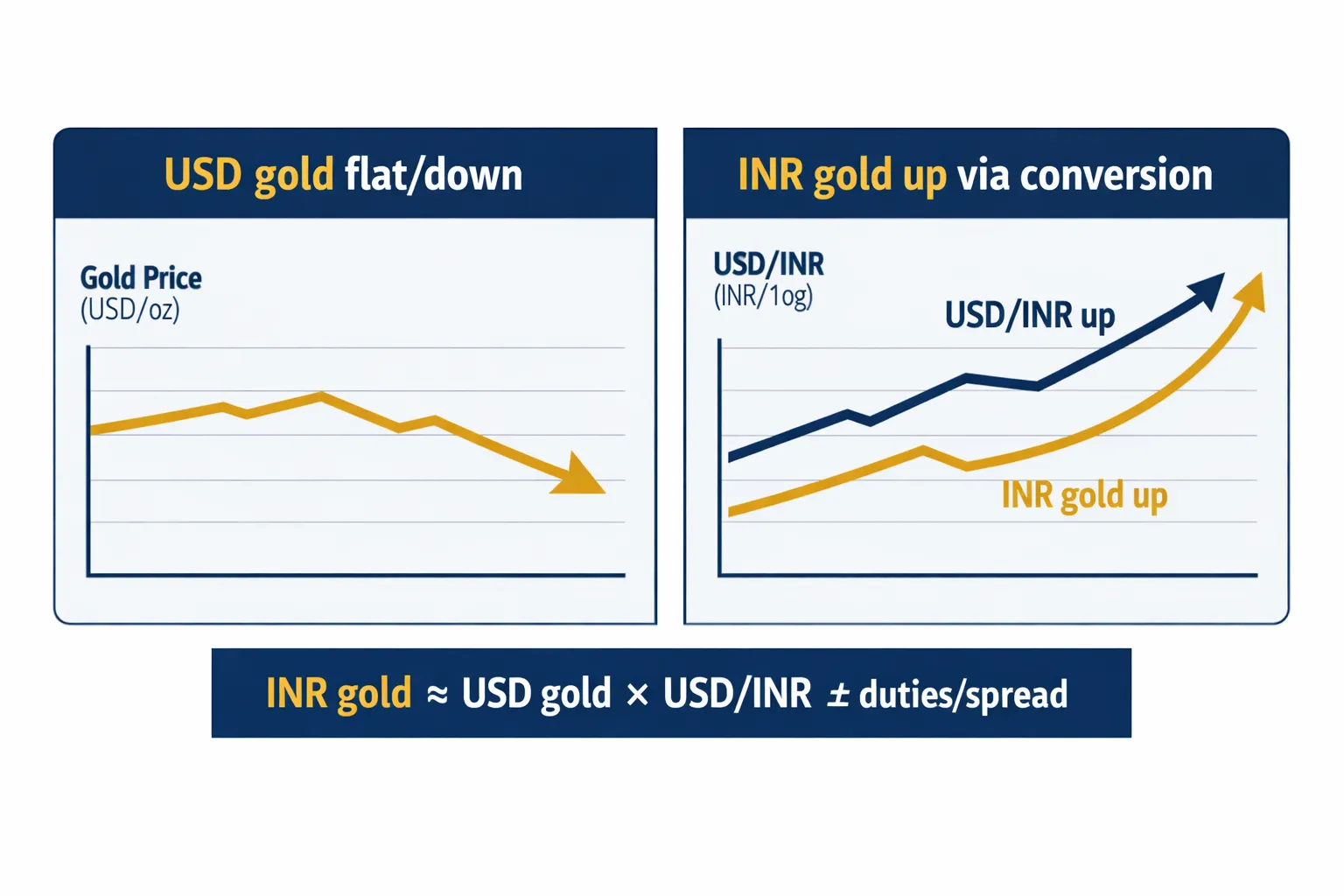

- INR: A weakening INR lifts local gold prices even if global prices are flat.

- Risk and liquidity: Geopolitical shocks, banking stress, or equity drawdowns push investors to safe havens.

Fast rules of thumb

- If you’re asking “Should I buy gold now?” and you don’t have exposure yet: start with a SIP today, then layer in buys on 2–5% dips.

- If you already have exposure: top up when real yields fall, INR firms, or ahead of India’s high-demand festivals – well before the last-minute rush.

“Central banks bought ~1,037 tonnes of gold in 2023 – near record highs.” – World Gold Council

6 Indicators To Check Before You Click “Buy”

1) Real interest rates (India and US)

- Falling real rates (nominal – inflation) are bullish for gold.

- Track India’s real rates via RBI policy rates minus CPI; for the US, watch 10Y TIPS yields. When real yields drift lower or go negative, gold’s opportunity cost falls – historically a tailwind for prices.

2) USD and DXY

- A weakening USD usually supports gold; a sharp USD rally can cap gains.

- Keep an eye on the DXY index. Dollar softness often lifts global bullion, while a rapid dollar spike can stall or reverse gold rallies in the short run.

3) INR and USD/INR

- A weaker INR mechanically lifts domestic gold prices; be tactical about big FX moves.

- Even if global gold is flat, INR depreciation pushes local prices up. If you’re asking “should I buy gold now?” and INR is sliding fast, consider staggering buys to avoid paying peak FX pass-through.

4) Inflation trend

- Rising/sticky inflation tends to support gold; disinflation can cool rallies.

- In India, track CPI and core inflation. Globally, watch US CPI and inflation expectations. Persistent inflation keeps real yields suppressed – typically positive for gold.

5) Rate path and liquidity (RBI/Fed)

- Cuts or dovish pivots are often supportive; tightening can weigh in the short term.

- Monitor guidance from RBI MPC and the Fed. Liquidity-additive moves (cuts, QE pauses) often help gold. Hawkish surprises can trigger pullbacks but may create attractive add-on opportunities.

6) Risk-on/off signals

- Geopolitics, banking stress, credit events, and equity sell-offs often spark safe-haven demand.

- If risk turns “off” (volatility spikes, equities tumble), gold typically benefits as capital seeks safety and liquidity.

“Gold prices tend to move inversely to U.S. real interest rates.” – World Gold Council

Pro tip: Build a simple watchlist (real yields, DXY, USD/INR, CPI prints, RBI/Fed meetings) and set alerts so buys are rules-based, not emotional. If you’re thinking “when should I buy gold,” use these signals to scale in: start a small SIP, then add on 2–5% dips or into dovish pivots.

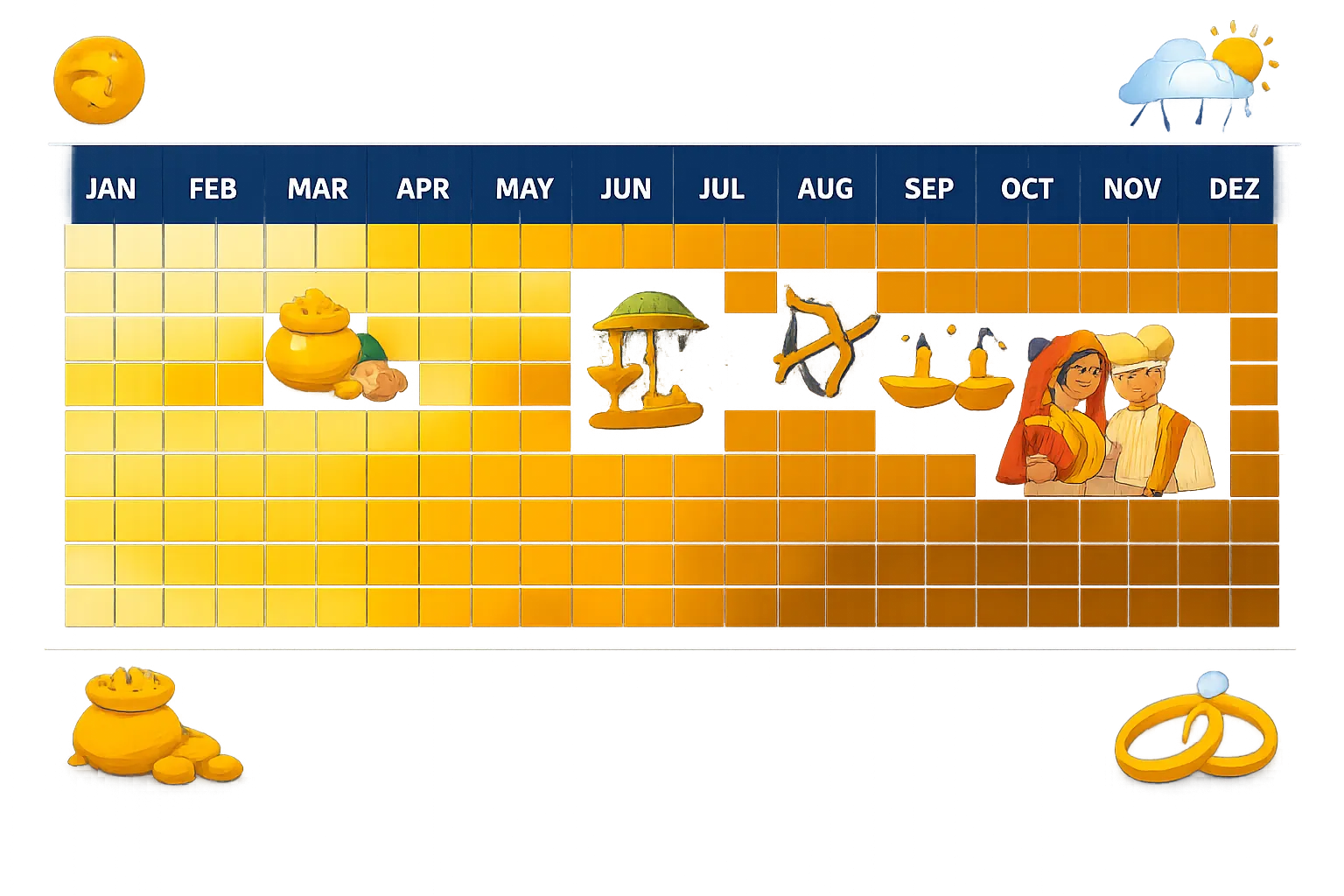

India’s Seasonality: Akshaya Tritiya, Dhanteras/Diwali, Weddings, and Monsoon Incomes

What seasonality looks like (and how to use it)

- Q2–Q4 bumps: Akshaya Tritiya (Apr/May), Onam (Aug/Sep), Dussehra, Dhanteras/Diwali (Oct/Nov), and the Oct–Mar wedding season.

- Demand tends to rise into these dates – so consider accumulating earlier rather than buying at the last minute.

Practical playbook

- Start accumulating 4–8 weeks before major festivals.

- If prices spike into the event, pause and resume SIP after demand normalizes.

- Keep a small “dip fund” to add on 2–3% pullbacks.

“Weddings account for around 50% of India’s annual gold demand, creating strong seasonal spikes around festival and wedding calendars.” – Source

India gold seasonality calendar

| Month | Key festival/wedding driver | Typical demand effect (qualitative) | Suggested approach (accumulate early / pause / buy-the-dip) |

|---|---|---|---|

| Jan | Winter wedding season, NRI visits | Moderate to strong | accumulate early |

| Feb | Peak weddings | Strong | accumulate early |

| Mar | Late-wedding season taper | Mild to moderate | buy-the-dip |

| Apr | Build-up to Akshaya Tritiya | Rising | accumulate early |

| May | Akshaya Tritiya month (some years) | High | pause |

| Jun | Post-festival lull, pre-monsoon | Softer | buy-the-dip |

| Jul | Monsoon onset; rural incomes pending | Softer | buy-the-dip |

| Aug | Onam/Raksha Bandhan build-up | Rising | accumulate early |

| Sep | Onam, pre-Dussehra/Diwali | Rising to strong | accumulate early |

| Oct | Dussehra; wedding season starts | High | pause |

| Nov | Dhanteras/Diwali peak | Very high | pause |

| Dec | Weddings continue; NRI buying | Moderate to strong | buy-the-dip |

When you’re asking “when is the best time to buy gold” in India, seasonality is your edge: accumulate early, pause into peak days, and deploy your dip fund after spikes.

Buy Now or Spread Out? Lump Sum vs SIP (and a Smart Hybrid)

Lump sum

- Best when macro is clearly supportive (falling real rates, stable INR, rising risk). Higher short-term timing risk.

SIP (DCA)

- Easiest for beginners. Reduces regret and timing risk. Works well across cycles.

Hybrid approach

- Run a base SIP + add tactical top-ups on dips (e.g., -3% to -5% from 30-day high) or when your indicator checklist turns green.

How to operationalize

- Fix a monthly SIP amount (e.g., ₹1,000+). Keep a separate dip fund (e.g., 20–30% of annual target) for opportunistic buys.

Lump Sum vs SIP vs Hybrid

| Lump Sum | SIP (DCA) | Hybrid | |

|---|---|---|---|

| Market path (rising, flat, choppy, falling then rising) | Excels in clear rising trends; can underperform in choppy/flat phases; tough during early drawdowns | Handles flat/choppy well; smooths falling-then-rising paths; may lag strong uptrends | Balances most paths; captures upside in rises, cushions choppy/falling-then-rising |

| Pros | Immediate full exposure; simple; benefits if macro turns strongly supportive | Reduces timing risk and regret; habit-forming; easy automation | Adds discipline + flexibility; can enhance returns with rules-based top-ups |

| Cons | High timing risk; emotionally hard if price dips right after | Slower to gain full exposure in strong rallies | Requires monitoring and rules; risk of overtrading if undisciplined |

| Who it suits | Confident, macro-aware investors with higher risk tolerance | Beginners and busy professionals who prefer autopilot | Intermediate investors who can follow signals and set alerts |

| Behavioral fit | Suits decisive personalities; can trigger regret if mistimed | Suits consistency-seekers; minimizes FOMO/FOLE | Suits balanced mindsets; combines consistency with opportunism |

Common Timing Mistakes Indians Make (So You Can Avoid Them)

- Chasing festival-day FOMO and paying higher premiums/spreads.

- Fix: Accumulate 4–8 weeks before Akshaya Tritiya/Dhanteras/Diwali, or run a SIP and add on small dips.

- Treating jewellery as investment (making charges 8–25%+ erode value vs 24K investment-grade gold).

- Fix: Separate “wear” from “wealth.” For investing, choose 24K investment-grade gold with transparent pricing and low spreads.

- Ignoring INR currency risk (domestic prices can rise even when global gold is flat).

- Fix: Track USD/INR alongside global gold. If INR is weakening quickly, stagger buys instead of going all-in.

- Using unregulated/unknown apps; weak buyback, opaque pricing.

- Fix: Choose RBI-compliant platforms with authorized bullion partners, insured vaults, and clear buy/sell quotes. OroPocket ticks all three – and adds Bitcoin rewards.

- Going all-in on one day instead of building a plan (SIP + dip buys).

- Fix: Start a base SIP, then add top-ups on 2–5% pullbacks or when your indicator checklist turns green.

- Forgetting exit planning (goals, target allocation, rebalancing rules, tax).

- Fix: Define why you’re buying (hedge, goals), your gold allocation, and when you’ll rebalance. Note tax treatment before selling.

- Not checking purity and storage: Prefer 24K investment-grade; ensure secure, insured vaulting when buying digital gold.

- Fix: Verify purity (24K), vaulting insurance, and custody. OroPocket offers 24K pure gold, 100% insured vaults, and instant UPI buys.

If you’re wondering “should I buy gold now” or “when should I buy gold,” avoid these traps and make it rules-based. Start from ₹1, automate a SIP, and earn free Bitcoin on every purchase with OroPocket. Download the app: https://oropocket.com/app

Why INR Matters: Currency, Duties, and Local Pricing

The pricing identity

- INR gold price ≈ International gold price (USD/oz) × USD/INR ± local duties, taxes, and dealer spread.

What this means for timing

- Even if global gold is flat, a weaker INR can push Indian gold prices up.

- Watch import duty and GST changes; they shift local price levels and spreads.

“If the INR depreciates by 1% against the USD, the local INR gold price typically rises by roughly 1%, holding USD gold constant (INR gold ≈ USD gold × USD/INR).” – Source

Practical takeaway

- Pair global signals (real yields, USD) with USD/INR moves. Avoid chasing spikes caused solely by abrupt INR weakness; let FX volatility cool before large buys.

Ready to buy smart, not emotional? Start a gold SIP from ₹1 on OroPocket, pay instantly via UPI, and earn free Bitcoin on every purchase. Download now: https://oropocket.com/app

Your Pre‑Purchase Checklist (10 Quick Questions)

- Have I set a target allocation (e.g., 5–10% of portfolio)?

- Are real yields falling or stable? Is the USD weakening?

- Is USD/INR calm or strengthening INR? Any duty/tax changes ahead?

- Am I 4–8 weeks ahead of major festival demand?

- Do I have a base SIP running and a small dip fund ready?

- Is my platform RBI-compliant with insured vaulting and clear buyback?

- Am I buying 24K investment-grade gold (not high-making-charge jewellery) for investment purposes?

- Have I checked spreads/premiums today versus last week?

- Do I have an exit or rebalance rule (by time, price, or allocation)?

- Have I avoided emotional trades and stuck to my plan?

Answer “yes” down the list and you’re ready to buy with confidence. Still thinking “should I buy gold now”? Start small, stay disciplined, and let your rules lead the way.

Start in 30 seconds with OroPocket. Buy from ₹1, pay via UPI, and earn free Bitcoin on every purchase: https://oropocket.com/app

Quick FAQs: Should I Buy Gold Now? Best Months? How Much?

Is it a good time to buy gold now?

- If you have zero exposure, yes – start with a SIP and add on dips. For tacticians, check real yields, USD/INR, and proximity to festivals.

- Translation: Don’t wait for the “perfect” bottom. Build exposure now, then layer in buys when the data lines up.

When is the best time to buy gold in India?

- 4–8 weeks before Akshaya Tritiya or Dhanteras, and during calm INR periods. Avoid last‑minute festival rushes when spreads can widen.

- Also watch RBI/Fed meetings and inflation prints; dovish turns often help gold.

Which months are usually better?

- Historically, pre‑festival accumulation windows often work better than festival day buys. But indicators and INR matter more than the calendar.

- If you’re unsure, automate a SIP to average through noise.

How much gold should I hold?

- Many diversified portfolios allocate 5–10% to gold depending on risk, goals, and other assets.

- Higher allocation can suit those seeking stronger inflation hedging; lower if equity-heavy and comfortable with volatility.

Lump sum or SIP?

- SIP for most investors; Hybrid (SIP + dip buys) for those tracking macro.

- Lump sum can work when real yields are falling, USD/INR is calm, and festival demand is still weeks away.

Make your plan simple and disciplined. Start a gold SIP from ₹1 on OroPocket, pay via UPI, and earn free Bitcoin on every purchase. Download the app: https://oropocket.com/app

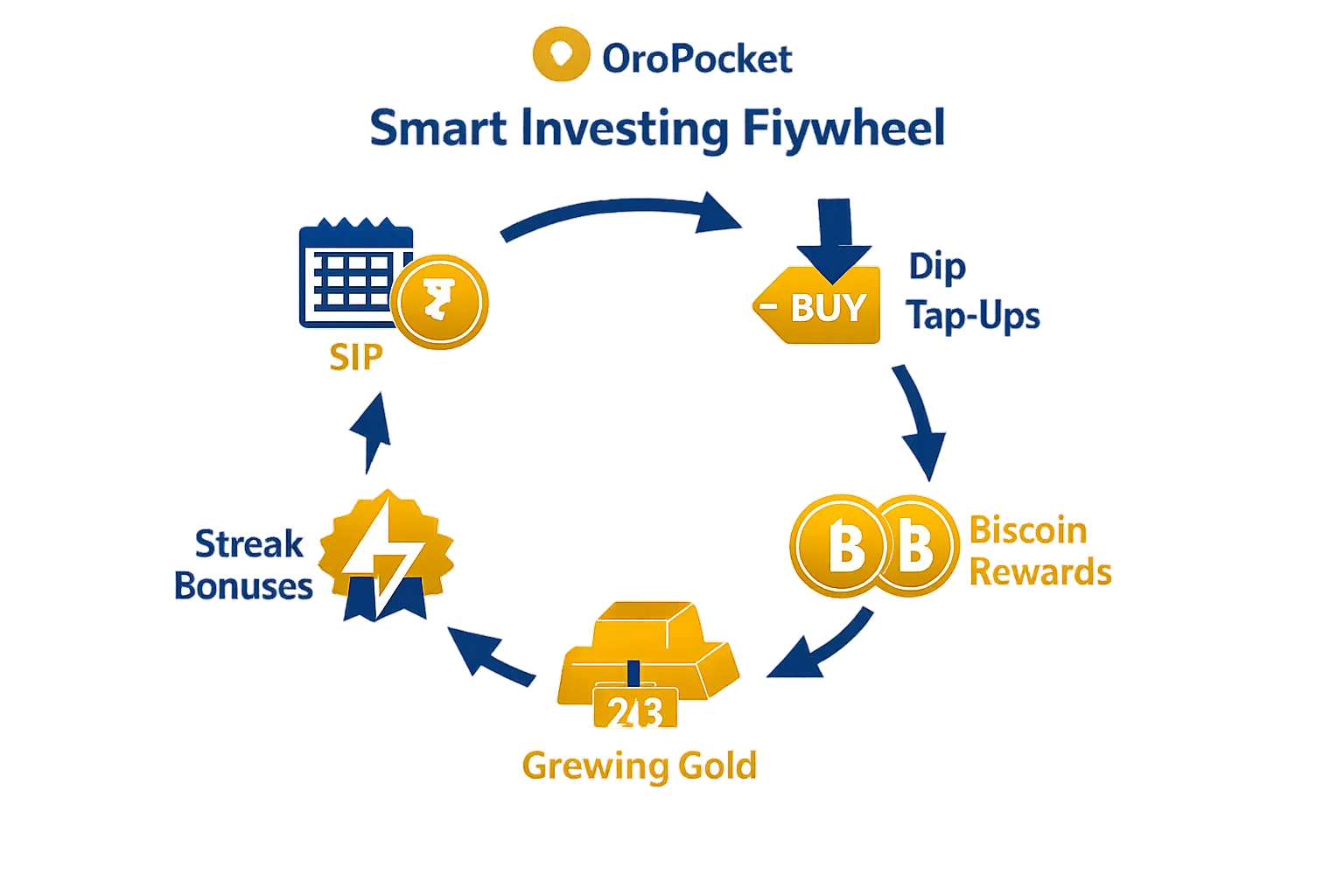

How OroPocket Helps You Time Smarter (and Earn Bitcoin on Every Buy)

Make timing simpler

- Micro‑investing from ₹1 via UPI: Start your SIP immediately – no waiting for a “perfect” day.

- Auto‑SIP + dip top‑ups: Build a base position, then add more when prices cool.

Get rewarded while you invest

- Free Bitcoin (Satoshi) cashback on every gold/silver purchase – unique combo of gold stability + Bitcoin upside.

- Daily streaks, Spin‑to‑Win, referral bonuses (100 Satoshi + free spin) to keep you consistent.

Trust and security

- 24K pure gold, 100% insured vaults, RBI‑compliant partners, transparent pricing and instant liquidity.

Why this matters for timing

- You don’t need to time perfectly. Build habits with SIP, capture dips with top‑ups, and let rewards compound your edge.

Conclusion: Don’t Overthink The Perfect Day – Start Small Today

- The best time to buy gold is when your plan says so: base SIP now, add on dips, and accumulate ahead of India’s festival peaks.

- Use the indicator checklist (real yields, USD, INR, inflation, policy) to guide top‑ups.

- Keep it simple, stay diversified, and avoid festival‑day FOMO and high making charges.